Fraud Watch: True Crime Stories

Protect Your Business From Fraud Podcast

Unrecognised transaction?

Report Fraud

- Fraud Awareness Events

- Top 5 Travel Tips

- Protect your everyday banking

- Protect your business

- How we protect you

- Help for older people

- Brochures and videos

- TextChecker

- Report Fraud

Fraud Awareness Events

Bank of Ireland runs one of the most comprehensive consumer fraud awareness programmes in Ireland as a central part of its commitment to safeguarding the financial wellbeing of its customers. The majority of members of the public surveyed see Bank of Ireland as the financial institution most associated with educating the general public about fraud (Red C, Feb ‘24).

Bank of Ireland will host a nationwide series of free fraud awareness events for consumers, and further dates and locations will be announced shortly.

Remember to Stop, Think, Check… and together we won’t let the fraudsters win.

**Subject to change

-

1. Before you go

Check that your cards and passport are still in date

We automatically replace cards about 2 weeks before the end of the month that your card expires. Your card will work for the entire month shown on the expiry date. In other words, if the expiry is shown as 10/26, the card will work until 31 October 2026.

Make sure we have your up-to-date contact details before you travel

It’s important that we have the right email and mobile, to make sure your transactions abroad (particularly outside Europe) are really yours. We might disable a card, if we can’t confirm that the genuine cardholder is using it. But it’s likely that we’ll try to get in touch with you to make sure this is a genuine transaction.

Key things to remember:

- Before you travel, please check your contact details are correct on the profile page of our mobile app. Simply click the profile icon on the top right of the main page and confirm your contact details are correct;

- Make sure that you check your text messages and emails, when you’re abroad so you don’t miss any that we might send;

- Be aware that if your mobile data is disabled or out of coverage, you will not be able to receive notifications, if we are trying to contact you;

- Where possible, use chip and PIN for transactions.

Lost and stolen cards: some important numbers

We’re here to help 24/7. Keep our emergency helpline numbers somewhere safe, so you can cancel any lost or stolen Bank of Ireland cards and organise replacements. We recommend writing our contact numbers down somewhere handy, along with other important numbers (for example, travel insurance, airline helpdesk), as well as keeping them on your phone or device.

- +353 56 775 7007 (outside the Republic of Ireland)

- 1800 946 764 (within the Republic of Ireland)

Keep your cards separate

If you have both credit and debit cards with you when you travel, we recommend that you keep them separate so that if you lose one, you still have your other card.

Emergency cash

Visa can arrange for cash to be available at a location near you if you need money when you’re waiting for a replacement card, having card acceptance difficulties or simply need cash in hand. We’re available to help you 24/7.

Contact us: +353 56 775 7007 (outside the Republic of Ireland).

Remember: you can temporarily freeze your card when you’re abroad using the B365 app.

-

2. Tips when using your card/digital wallet abroad

- Check your purchase receipt before you sign or enter your pin – this is to make sure it’s for the correct amount;

- Keep receipts from cash machines and check them on B365 app;

- Do not give your PIN to anyone, including anyone claiming to be from the police or a card company;

- Always keep a close eye on your card or device (if using a digital wallet) when transactions are taking place. Where possible, use physical card, chip and PIN for payment. Do not let your cards out of your sight, to avoid the possibility of your card being skimmed (illegally collecting data from the magnetic stripe of your card). If you are having a problem with your digital wallet, please use another method such as your physical debit or credit card with Chip and Pin authorisation.

We’re available to help you 24/7.

Contact us: +353 56 775 7007 (outside the Republic of Ireland).

Remember: you can temporarily freeze your card when you’re abroad using the B365 app.

-

3. Accommodation scams

Rental accommodation scams aim to trick you into paying rent for property that doesn’t exist or is not actually available to rent. These scams happen throughout the year, but there’s an increase in the holiday season.

In some cases, fraudsters will say that they’re out of the country and unable to meet you when you arrive but will ask for money upfront or for a deposit to hold the property. There are even cases where fraudsters have hired properties to use for viewings to trick renters into handing over a deposit. They may even provide fake keys.

Remember to Stop, Think, Check.

How to avoid holiday rental accommodation scams:

- Use established letting agencies;

- Be extra vigilant when searching for a rental property online and not through an established letting agency;

- Ask for identification from the landlord or letting agent (for example, a driving licence);

- Get a second opinion from a trusted family member or friend;

- And always remember - if it sounds too good to be true it probably is!

If you think you have fallen victim to a rental accommodation scam, we’re available to help you 24/7, call us on:

- +353 56 775 7007 (outside the Republic of Ireland)

- 1800 946 764 (within the Republic of Ireland)

Remember: you can temporarily freeze your card when you’re abroad using the B365 app.

-

4. Using cash machines abroad

- Use well-lit, properly-maintained cash machines, beside a bank if you can as these usually have security cameras and are less likely to be tampered with.

- Avoid using a cash machine that is in poor condition, or appears to be altered in some way.

Be aware of Shoulder Surfing - Don’t get side-tracked by others when you’re using the machine and take care not to let anyone see your PIN. Memorise your PIN, don’t write it down.

- Have your card ready when you go to cash machines, to avoid searching through your wallet or handbag to find it;

- Make sure you don’t let others see your PIN, when typing it in;

- Memorise your PIN and do NOT leave it in a wallet or purse along with your card;

- Remember the basic steps. It’s just like using a cash machine at home:

1. Insert your card and choose your language

2. Enter your PIN and the amount you want to withdraw

3. Remove your card, collect your cash and keep your receipt - If your card is lost or stolen, or if you have problems using your card, call us immediately on +353 56 775 7007 (outside the Republic of Ireland). We’re available to help you 24/7.

- If you need to get cash, be aware that many countries only allow a maximum withdrawal of €100 or £100. Our website has a list, under Cash withdrawal limits abroad

- Fees and charges may apply when using cash machines abroad. Please see the terms and conditions, so you know how much cash machines may cost

Remember: you can temporarily freeze your card when you’re abroad using the B365 app.

-

5. If you’re being pressured to make a payment

Feeling that you’re being pressured to pay for something at a highly inflated price?

If this happens or you feel under pressure to make a payment, report the matter to the local authorities and contact us immediately on +353 56 775 7007 (outside the Republic of Ireland). We’re available to help you 24/7.

Remember: you can temporarily freeze your card when you’re abroad using the B365 app.

Stop, Think, Check… and together we won’t let the Fraudsters win.

Protect your everyday banking

We are committed to keeping your everyday banking secure so you can manage your accounts and payments with confidence.

To help you learn how you can protect yourself from fraudsters, read our guidance so that you can spot common scams and know how to avoid them.

While we may contact you to discuss the operation of your account, to send you product related messages, or for feedback on your banking experience, please remember these points:

-

Bank of Ireland will never:

- Send you a text or email with a link directly to the login page of our online banking channels.

- Send you a text or email with a direct link to your latest e-Statement.

- Ask you to click a link in an email with an urgent warning about suspicious activity on your account. (We may sometimes send you an email to verify a transaction on your account but we will never ask you to provide confidential information or click a link to verify a transaction).

- Ask you to share or send us your full six-digit 365 PIN, four-digit card PIN or Business On Line credentials

- Ask you to send us back your bank card

- Ask you to transfer money out of your account to protect yourself from fraud.

- Request your account information through an onscreen pop-up window.

- Call you to ask you to make a payment to another account.

- Ask you to tell us any ‘one-time password’ or code that you have received from us by text.

-

Bank of Ireland will ask you for:

- Three random digits from your 6-digit 365 PIN – never more, never less.

- Your full 365 online user ID and

- Either your date of birth or the last four digits of your phone number – never both

-

Top tips to keep your accounts safe:

- Protect your PIN. Never share your online banking PIN or card PIN with anyone. Remember: Bank of Ireland will never ask you for your full six-digit 365 PIN.

- Cover your PIN. Make sure you are not being overlooked or distracted when entering your PIN in a public place, such as at an ATM or supermarket checkout.

- Beware of links in fake texts and emails. Don’t click on any unexpected links or attachments – they could infect your device or direct you to a fake website designed to collect your personal and account information.

- Beware of fake calls claiming to be from Bank of Ireland or another trusted company. Remember: Bank of Ireland will never ask you to transfer money out of your account to protect yourself from fraud.

- Check your accounts regularly for any unusual activity. If you do find anything suspicious, tell us.

- Use up to date anti-virus software and always keep operating system software up to date with the latest versions on all your devices.

- Keep your passwords secure. Use strong passwords that cannot be easily guessed and use a different one for each online account.

- Limit what you share on social media. The more information you share, the more you put yourself at risk of identity theft and fraud.

- Alerts are push notifications that we send to customers’ mobile phones or tablets. Today we send alerts for a number of different reasons. These could be general fraud warnings for example, or to let you know that an action is required through the app. For more information, please click here.

- Freeze your cards. Doesn’t feel right, can’t locate your card - freeze your card while you check it out. For more information, please click here.

Protect your business

Businesses and organisations are increasingly becoming targets of fraud and cybercrime.

We have created a helpful checklist of Bank of Ireland Business On Line’s tools available to help protect customers with the security of their online banking. For more information, please click here.

We want to help our customers protect themselves from common threats such as ransomware, payment redirection fraud, email compromise, cheque overpayment and more.

For more information and helpful tips for you and your staff, please click here.

How we protect you

Read about the ways in which we protect you.

-

How we protect you

Online Security

- Our online banking websites are encrypted to protect your information

- They are also protected by a firewall (a barrier between the internet and our internal bank network)

- A secure browser is needed to access account information and transact

Logging on and Timing out

When you log on to Bank of Ireland 365 online, we’ll ask you for:

- A private and individual User ID

- 3 random digits from your 365 login PIN

- A push notification will be sent to your registered mobile device or PSK asking you to approve the login, you will need to swipe to approve.

This information is encrypted and will stay private if you don’t disclose it.

- For Business On Line customers, your last log on details will show when you log on. This means you’ll know if someone else has accessed your account online

- If you’re inactive for a while, your online banking session will automatically time out after 5 minutes

Two Factor Authentication

- You need a Two Factor Authentication to add or edit a payee on 365 online

- We’ll text a code to your registered mobile phone, or send via post if you prefer

Protecting your business with Bank of Ireland Approve

- Business On Line uses HID Approve. Approve has been developed by BOI’s chosen security partner HID Global, an industry leader in secure authentication solutions.

- Approve generates unique, one-off Secure Codes you can use to log on to Business On Line and authorise payments and payees

- Approve offers the following security benefits:

- You need a PIN to generate Secure Codes. A unique Secure Code is generated per transaction and expires when used, or after 60 seconds

- Approve doesn’t store any information

- Approve only works on your registered device, along with your corresponding Business on Line User ID

- The app is registered to the individual User

- The Business On Line Administrator can lock a User’s profile (for example, if the User goes on holidays, etc.)

- Read more about Bank of Ireland Approve here

Daily Control Limit

- The Administrator and your relationship manager will set a Daily Control Limit (DCL) on your Business On Line profile

- This limit means your profile is less likely to be exposed to fraud

Protect your Business From Fraud (Business On Line customers)

We have created a helpful checklist of Bank of Ireland Business On Line’s tools available to help protect customers with the security of their online banking here

Help for older people

For those of us that didn’t grow up using computers every day they can sometimes seem confusing and more than a little scary, but that’s no reason not to use them.

Computers and the internet open up a world of information and experiences to all age groups, allowing us to keep in touch with friends and relatives a thousand miles away, or in the next village. We can order groceries for delivery from the comfort of our homes. Missed that programme on TV? No problem! Catch-up TV is hugely popular on the internet. Whether it’s making everyday tasks easier or learning new skills, the internet can help.

However, as well as opening up lots of positive opportunities there are plenty of people looking to take advantage of internet users, whatever their age.

To read more, please click here.

Brochures and videos

Brochures

To help you learn how you can protect yourself from fraud, read our guidance so that you can spot common scams and know how to avoid them. To read and download our brochures, please click here.

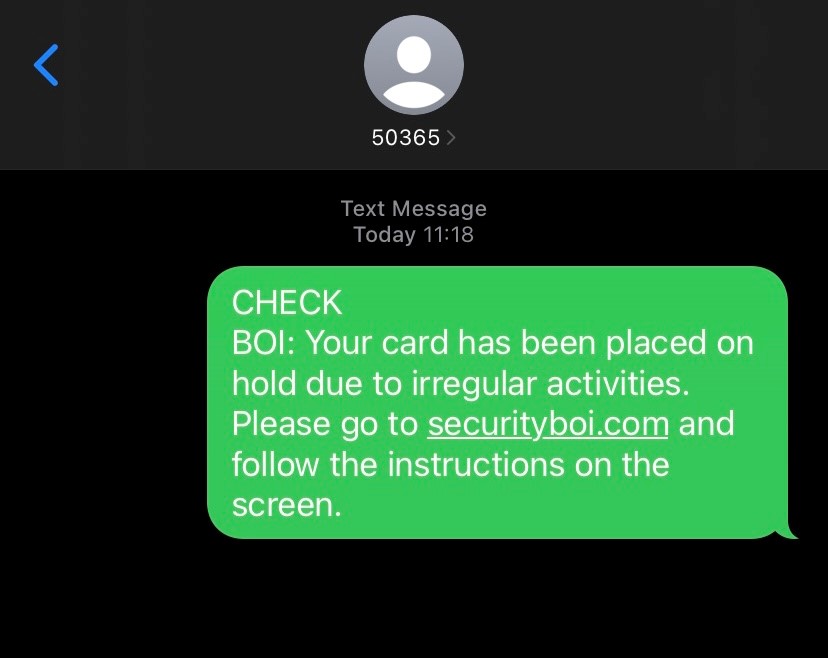

TextChecker

Fraudsters can try to trick you into giving away your personal and financial details, by sending fake texts mixed in with real Bank of Ireland texts. If you get a text that says it’s from Bank of Ireland, use our ‘TextChecker’ service to check it’s not a scam.

Sample TextChecker submission:

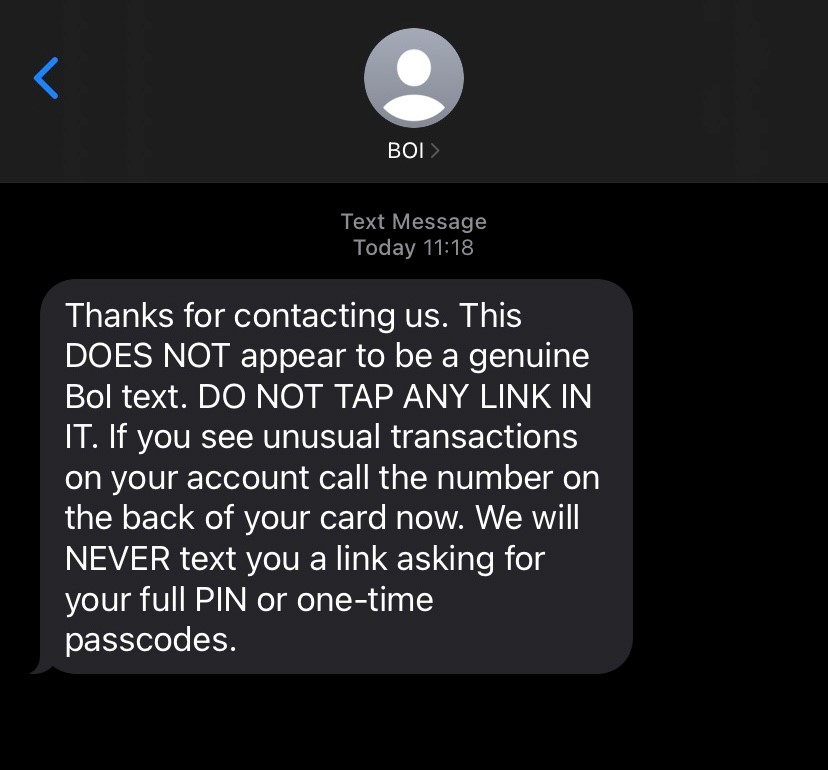

Sample TextChecker response:

Remember, Bank of Ireland will NEVER text you a link asking you to share your card details or your online banking details like your PIN or one-time passcodes.

Report fraud

Please get in touch with us if you:

- shared your online login, card or banking details in response to a suspicious call, text or email;

- believe your card has been lost or stolen (top tip – if you think you might have just misplaced your card, you can temporarily freeze/unfreeze it via the app or 365 online);

- notice suspicious activity or unauthorised transactions on your account;

- need to report online or ATM fraud.

Emergency Contact Numbers

Available 24 hours 7 days a week

Republic of Ireland

Freephone: 1800 946 764 (personal and business)

Great Britain & Northern Ireland

Freephone: 0800 121 7790 (personal and business)

Everywhere outside Republic of Ireland, Great Britain & Northern Ireland

Not Freephone + 353 1 679 8993

Not Freephone + 353 56 775 7007 (Lost/Stolen cards or smart device)

Report a suspicious email or text

To report suspicious Bank of Ireland related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com or click here now